On the subject of defending your money long run, coverage ideas are a vital facet to look at. Think about insurance plan as a safety Internet. It catches you when everyday living throws unanticipated issues your way. No matter whether it’s health concerns, auto mishaps, or perhaps a home hearth, the right insurance approach can be a lifesaver. But with so many alternatives readily available, how Are you aware which plan is finest to suit your needs? Let’s dive in and examine what insurance policies designs are, why they’re crucial, and how to pick the suitable 1 for your preferences.

Insurance programs are effectively agreements amongst you and an insurance company. In exchange for shelling out frequent rates, the insurance company agrees to offer monetary help in the celebration of certain dangers or losses. Think of it just like a subscription to comfort. By establishing an insurance plan strategy, you happen to be effectively transferring a number of the economical hazards you confront to your coverage company. This implies less strain if the surprising occurs.

The Ultimate Guide To Alternative Insurance Solutions

Different types of coverage plans are made to go over many dangers. Wellness coverage designs, for example, aid include professional medical prices, making sure that should you be sick or injured, you received’t must pay back the entire rate for procedure outside of pocket. Auto coverage, Then again, protects you in the fiscal fallout of a collision, which includes repairs, legal expenses, and damages. Similarly, existence insurance designs assure your loved ones are financially secure if a little something takes place to you personally.

Different types of coverage plans are made to go over many dangers. Wellness coverage designs, for example, aid include professional medical prices, making sure that should you be sick or injured, you received’t must pay back the entire rate for procedure outside of pocket. Auto coverage, Then again, protects you in the fiscal fallout of a collision, which includes repairs, legal expenses, and damages. Similarly, existence insurance designs assure your loved ones are financially secure if a little something takes place to you personally.Picking out the suitable coverage system may be overpowering simply because there are numerous selections. It is like going for walks right into a sweet keep using an endless range of sweets. But equally as you would probably pick the sweet you like finest, you should choose the insurance policies approach that matches your requirements. The important thing is to evaluate your hazards and decide which kind of protection will offer you essentially the most protection without breaking the financial institution.

Well being insurance options are Probably the most necessary sorts of protection. Health-related expenses can promptly increase up, and a superb wellness plan ensures you aren’t drowning in financial debt once you want health care care. Health and fitness insurance could also present use of common Check out-ups, preventive treatment, and prescription prescription drugs. With all the mounting expense of healthcare, a comprehensive wellness insurance policy system isn’t just a luxury – it’s a requirement.

Car insurance coverage is an additional significant sort of security. It doesn’t just shield your automobile from destruction but also covers liability in the event of a collision. In some cases, it even addresses clinical fees for injuries you maintain during an auto crash. You will discover unique levels of protection available, such as legal responsibility, collision, and comprehensive insurance coverage. Every sort offers diverse levels of protection, so it is important to choose one according to your requirements and budget.

Homeowners’ insurance policy programs secure 1 within your most vital investments: your property. This kind of protection commonly involves defense versus organic disasters, hearth, theft, and vandalism. It might also supply liability coverage if someone receives hurt on your own house. Supplied the amount of we invest in our households, homeowners' insurance plan is essential-need to secure your financial upcoming and ensure you're not left significant and dry if catastrophe strikes.

Renters insurance is yet another well known alternative, especially for people that don’t own their households. Even though landlords are required to have coverage within the house, renters are frequently left to fend for themselves if their belongings are weakened or stolen. Renters insurance is reasonably priced and offers protection for personal residence, liability, and extra residing charges if your house results in being uninhabitable.

In terms of existence insurance, Lots of individuals don’t consider it till later on in everyday life. But the sooner you invest in a everyday living insurance plan system, the better. Lifestyle insurance policies makes sure that All your family members is financially shielded if one thing comes about to you. It could address funeral bills, pay back credit card debt, and provide on your family members within your absence. You will discover different types of daily life insurance policies options, which include phrase everyday living and whole existence, each supplying different levels of protection and Gains.

Incapacity insurance policy is made to offer profits substitution for those Learn what’s new who’re not able to work on account of ailment or personal injury. For many who count on their own paycheck to protect residing bills, incapacity insurance policy is usually a lifesaver. It's A necessary Section of a very well-rounded financial program, particularly if you work inside of a bodily demanding career or are self-utilized. With the best incapacity plan, you received’t have to worry about how to pay the costs Whilst you Get well.

How Insurance Solutions For Individuals can Save You Time, Stress, and Money.

For people who love journey, vacation insurance policies is something to consider. Whether or not it is a canceled flight, shed luggage, or medical emergencies abroad, vacation insurance policy presents peace of mind. With regards to the plan, it may possibly include a wide array of eventualities, ensuring you're not still left stranded or economically burdened even though absent from home. It’s one of those stuff you hope you by no means require, but are grateful for In case the unanticipated occurs in the course of your trip.Extended-term treatment insurance plan options in many cases are forgotten, but they supply coverage for nursing household care, assisted dwelling, As well as in-residence treatment companies. As we age, our capacity to conduct everyday functions may well diminish, and lengthy-phrase care coverage helps address the costs of these solutions. It’s a crucial sort of insurance coverage for seniors or People setting up for retirement, as healthcare costs in previous age may be prohibitively high-priced without the need of this protection.

Pet insurance strategies absolutely are a soaring trend among pet homeowners. Much like well being insurance for people, pet insurance policies allows cover clinical charges on your furry mates. Vet visits, surgical Discover the truth procedures, remedies, and medicines can swiftly include up, and a superb pet insurance policy plan can ensure that your pet gets the best treatment with out putting a strain on your funds. It’s an financial investment inside the health and joy of your pets.

Certainly one of some great benefits of insurance policy options is that they provide you with a money basic safety net, helping you continue to be afloat through hard instances. But Are you aware a large number of designs also offer you added benefits? By way of example, some health insurance policy strategies offer you wellness courses, discounts on gymnasium memberships, and preventative treatment services. Auto coverage organizations may supply special discounts for safe driving, although homeowners’ insurance coverage policies usually supply discounts for putting in protection devices.

Whenever you’re looking for insurance coverage, it’s essential to Assess options from distinctive companies. Each individual insurance provider presents slightly different conditions, protection selections, and pricing. Imagine it like searching for a pair of jeans; you wouldn’t accept the primary pair you try on with out ensuring that they fit just right. By comparing diverse insurance policies strategies, you be certain that you’re getting the most effective deal for your preferences.

Excitement About Insurance Solutions For Healthcare

Don’t forget about to read the good print! Insurance coverage policies can be advanced, and it’s essential to know the conditions right before committing. Some ideas might have exclusions or limitations which could leave you uncovered in particular cases. As an example, some overall health insurance plan designs don’t address particular treatment plans or pre-current conditions, plus some automobile insurance policies guidelines may exclude particular types of incidents. Usually examine the conditions and question queries if a thing doesn’t sound right.

One more significant thought is your funds. When it’s tempting to choose the cheapest insurance plan program, it’s vital to balance cost with coverage. The last thing you wish is to economize upfront, only to discover that the coverage doesn’t offer satisfactory security after you require it Visit this page most. Try to find a plan that fits easily in your funds while providing sufficient coverage for your needs.

Insurance plan strategies are all about running threat. Life is full of uncertainties, but with the ideal coverage, you could lower the fiscal impression of These uncertainties. Irrespective of whether it’s a well being emergency, an auto accident, or a home repair service, coverage is there that can assist you recover devoid of draining your banking account. By deciding upon the appropriate insurance coverage prepare, you are not only preserving your foreseeable future but in addition buying your peace of mind.

In conclusion, insurance programs are A vital Portion of any monetary system. They offer defense, security, and comfort, guaranteeing that you just’re covered when life throws you a curveball. From health and fitness insurance policy to pet insurance policy, there’s a program on the market For each need to have. The true secret is to understand your hazards, compare diverse choices, and choose the approach that best fits your Life-style. So, why wait around? Make the effort currently to safe your financial potential with the right insurance plan system!

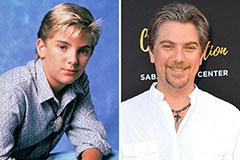

Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!